Solana Mobile’s Seeker Season 1 just wrapped, delivering over 265 decentralized apps, 9 million transactions, and a whopping $2.6 billion in on-chain volume. If you’re a Saga or Seeker phone holder, this means your device is now a powerhouse for solana seeker skr rewards. The SKR token launched on January 21,2026, with a fixed 10 billion supply and nearly 2 billion allocated for airdrops. Whether you hit Scout tier at 5,000 SKR or Sovereign at 750,000 SKR, it’s time to secure and grow those rewards securely on your mobile-first setup. Your keys, your crypto, your control.

Current SOL sits at $116.79, down slightly by -0.000090% over 24 hours, with a high of $118.94 and low of $112.94. This stability is perfect for funding your Seeker wallet without overpaying on gas for claims. Season 1 rewarded engagement, from casual scouts to luminary power users. Missed bigger allocations? No sweat; staking and farming open doors to catch up fast.

Recap Your Season 1 SKR Allocation and Claim Window

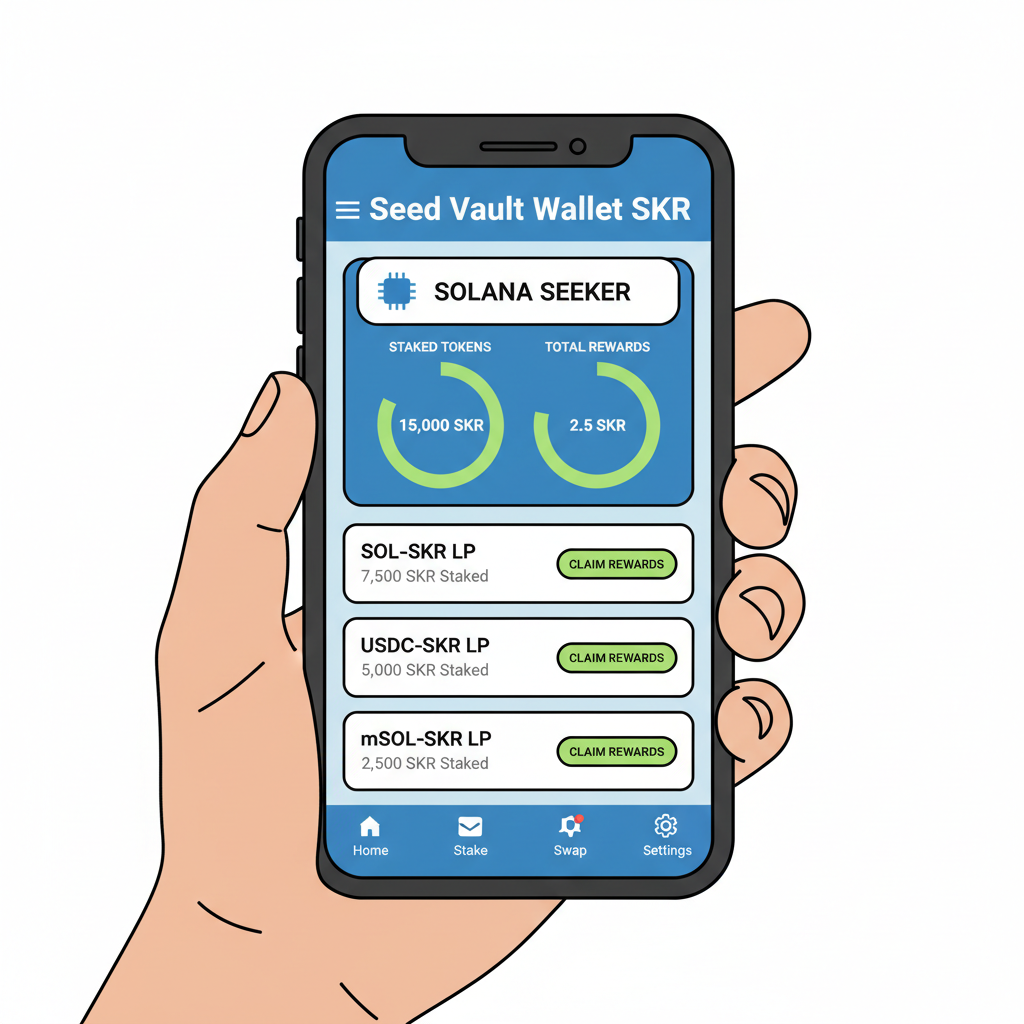

Eligibility hinged on activating your Seeker Genesis Token during Season 1, plus developer dApp submissions. Five tiers structure the drops: Scout (5,000 SKR), Prospector (10,000), Vanguard (40,000), Luminary (125,000), and Sovereign (750,000). Claims kicked off January 21 via Seed Vault Wallet’s Activity Tracking tab, needing just 0.015 SOL in fees. You’ve got 90 days, but why wait? Prompt claims lock in your bag before any hiccups.

Over 40% of Seekers who got SKR allocations are already staking, per Solana Mobile updates.

Security first: Double-check you’re on the official Seed Vault app. Phishing scams love airdrop hype, so verify URLs and never share seeds. On your Saga or Seeker, the integrated wallet keeps everything native and secure.

Strategy 1: Mint Your. skr Wallet Address and Fund with SOL

Before anything, set up your . skr wallet address right on the Seeker. Open Seed Vault, mint the address, then fund with a touch of SOL – aim for 0.02 SOL to cover fees comfortably at today’s $116.79 price. This step unlocks claims and staking. I recommend doing it now; Reddit threads buzz with users who delayed and hit snags. Your Saga phone’s dApp store makes this seamless, bridging mobile DeFi effortlessly.

Pro tip: Use the phone’s biometric locks for extra layers. No seed exposure means zero compromise.

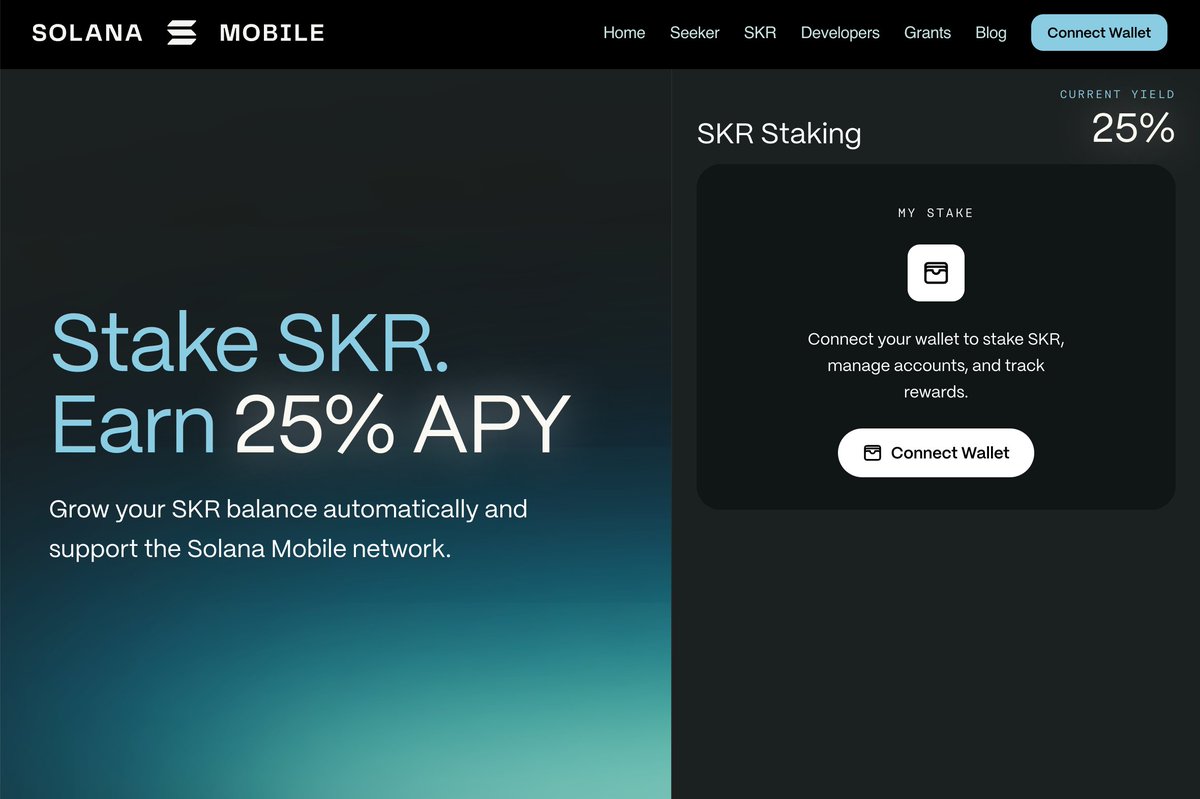

Strategy 2 and 3: Claim Promptly and Stake in Zero-Commission Pools

Next, claim your full Season 1 SKR airdrop allocation pronto. Head to Activity Tracking, approve the tx, and boom – tokens in wallet. Immediately pivot to staking SKR in zero-commission pools for those juicy 48-hour inflation rewards. No fees eat your yield, and unstaking has a 48-hour cooldown, so plan cycles wisely.

SKR (Solana Seeker Rewards) Price Prediction 2027-2032

Projections based on staking rewards, DePIN boosts, Solana Mobile ecosystem growth, and market cycles following 2026 launch

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $0.015 | $0.045 | $0.120 |

| 2028 | $0.025 | $0.080 | $0.250 |

| 2029 | $0.040 | $0.150 | $0.500 |

| 2030 | $0.060 | $0.280 | $1.200 |

| 2031 | $0.100 | $0.550 | $2.500 |

| 2032 | $0.200 | $1.200 | $5.000 |

Price Prediction Summary

SKR is forecasted to see robust growth from 2027-2032, driven by 48-hour staking rewards at 0% commission, 2x DePIN earning boosts via Guardians, and deepening integration with Solana Seeker devices. Average prices could surge over 25x from $0.045 to $1.20, with maximums hitting $5.00 in bullish adoption scenarios. Minimums reflect bearish risks like market downturns or regulatory hurdles, while progress aligns with Solana’s expansion and crypto cycles.

Key Factors Affecting Solana Seeker Rewards Price

- High staking APY and frequent 48-hour reward events with zero commission

- DePIN protocol integrations offering 2x earnings multipliers

- Fixed 10B token supply and 20% airdrop allocation fostering scarcity

- Solana ecosystem growth, including 265+ dApps and $2.6B Season 1 volume

- Seeker device adoption and dApp Store engagement for future rewards

- Correlation with SOL price trends (currently ~$117) and broader market cycles

- Potential regulatory clarity for mobile crypto hardware

- Competition from other DePIN projects and macroeconomic factors

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Staking boosts governance too, letting you vote on Solana Mobile’s future. On Seeker, this feels native – tap, stake, earn. I’ve seen early stakers compound nicely; at SOL’s steady $116.79, transaction costs stay predictable.

Check out more ways to earn on Saga and Seeker for aligned tactics. Up next, compounding and farming to supercharge your mobile defi skr farming.

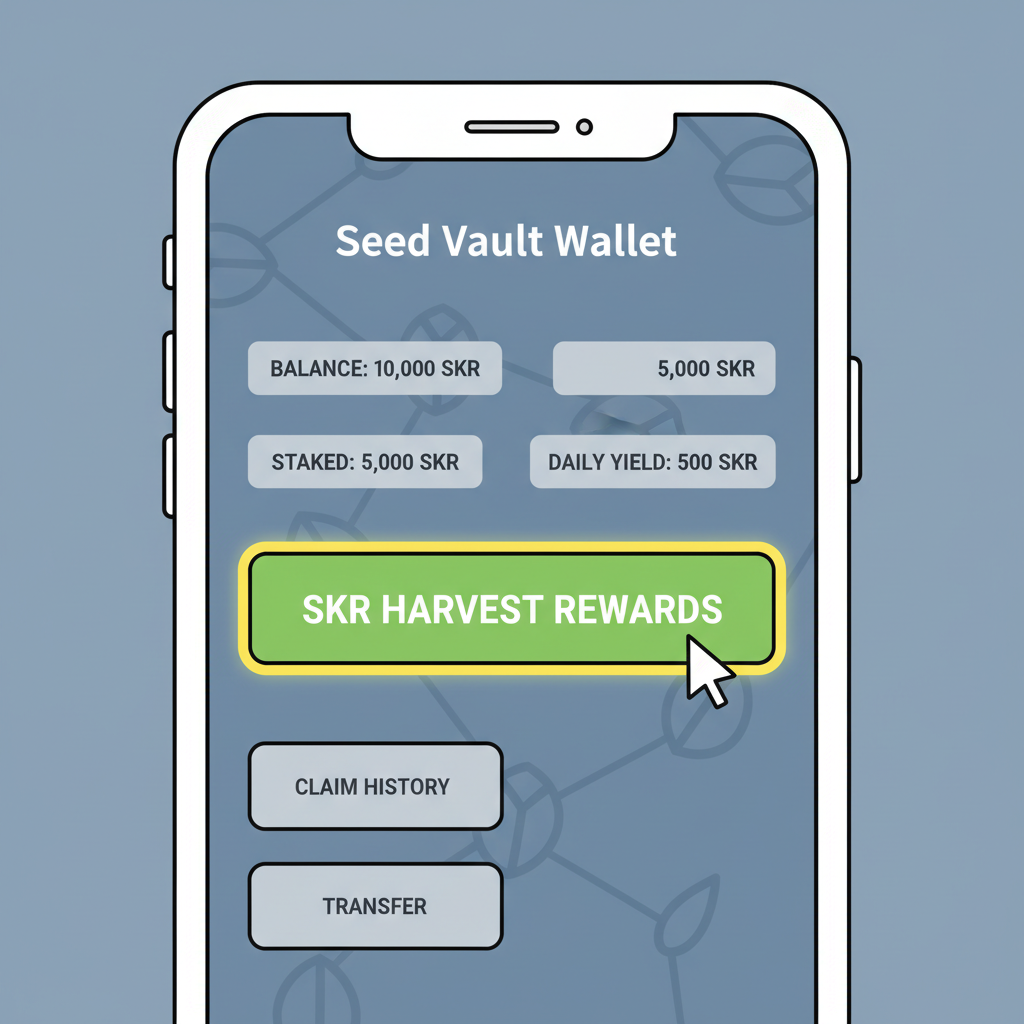

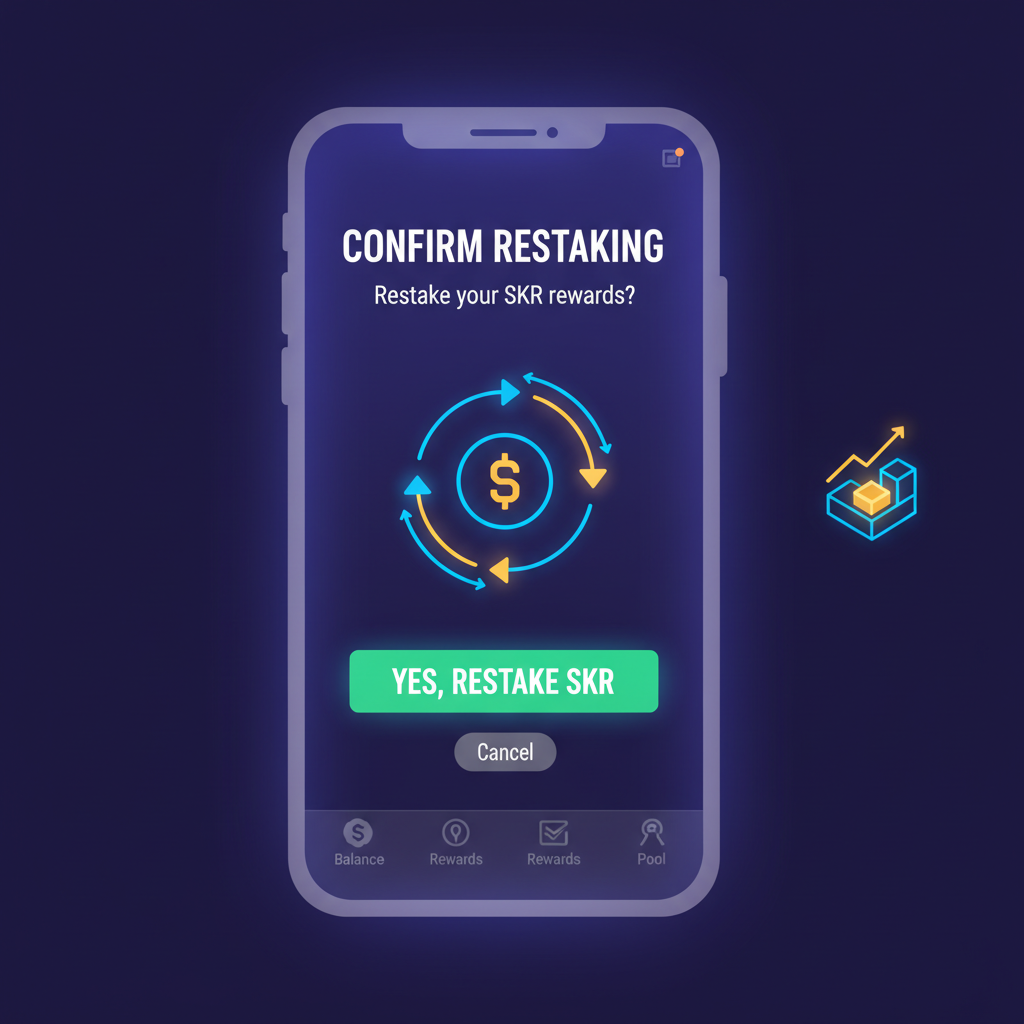

Strategy 4: Compound Earnings by Restaking Rewards Each Event Cycle

Once your SKR is staked and those 48-hour inflation rewards hit, don’t let them sit idle. Compound earnings by restaking rewards each event cycle – it’s the quiet multiplier that turns good yields into great ones. Every two days, claim your rewards in Seed Vault, then restake instantly. This snowballs your position without extra SOL fees beyond the nominal tx cost at $116.79 per SOL.

On my Seeker, this process takes under a minute per cycle. Security stays tight: transactions sign via biometrics, no clipboard risks. I’ve watched users double effective APY this way during early Season 1 staking phases. Track cycles via the wallet’s dashboard to never miss a beat. Pair this with solana seeker skr rewards monitoring apps in the dApp store for alerts.

Restaking also amps your governance weight, influencing SKR’s path forward. Think long-term: compounded stacks position you for DePIN boosts, where staked SKR unlocks 2x coefficients across protocols.

Strategy 5: Farm Bonus SKR via Integrated Mobile DeFi dApps on Saga/Seeker

The real edge? Farm bonus SKR via integrated mobile DeFi dApps right on your Saga or Seeker. Season 1’s 265 and dApps set the stage; now dive into yield farms, liquidity pools, and quests tied to SKR. Apps like those in the Solana dApp Store offer SKR multipliers for holding staked positions or providing liquidity.

SKR Allocation Tiers vs Max Potential Farmed Rewards

| Tier | Base SKR Allocation | Max Potential Farmed Rewards (SKR) | Total Potential SKR |

|---|---|---|---|

| Scout | 5,000 | 2,000 | 7,000 |

| Prospector | 10,000 | 5,000 | 15,000 |

| Vanguard | 40,000 | 20,000 | 60,000 |

| Luminary | 125,000 | 60,000 | 185,000 |

| Sovereign | 750,000 | 300,000 | 1,050,000 |

Start with low-risk farms: stake LP pairs involving SKR/SOL, earn extra emissions. At SOL’s $116.79 stability, impermanent loss stays manageable. I prioritize dApps audited for mobile, avoiding rug risks. Your phone’s Seed Vault integrates seamlessly, auto-routing rewards to your. skr address.

Security reminder: Enable dApp permissions only for trusted apps, revoke post-farm. Over 9 million tx from Season 1 prove the ecosystem’s maturity, but vigilance rules. Farming here beats desktop hassles – notifications ping your lockscreen for harvests.

Top 5 Strategies Ranked for Solana Mobile Seeker Season 1 Success

To recap your solana seeker airdrop recap, here’s the hierarchy that maximizes earn skr tokens saga phone:

- Mint. skr wallet and fund with SOL – foundation step.

- Claim full allocation promptly – secure the base.

- Stake in zero-commission pools – ignite rewards.

- Compound every cycle – accelerate growth.

- Farm via dApps – unlock bonuses.

Executing all five on Seeker turns your device into a passive income machine. Season 1’s $2.6B volume shows momentum; stakers now lead with 40% and participation.

For deeper mobile DeFi flows, explore Saga’s Veera app guide. Stay plugged into official channels – next seasons promise bigger multipliers. With SOL at $116.79, low fees mean more SKR in your control. Mint, claim, stake, compound, farm: your roadmap to thriving in mobile crypto.