Solana Mobile’s Seeker phone has ignited fresh excitement among mobile crypto enthusiasts, especially with the launch of the SKR token airdrop distributing nearly 2 billion tokens to over 100,000 Seeker users and developers. If you’re a Saga phone owner eyeing solana seeker rewards, this guide unlocks how to dive into SKR tokens Season 2 mechanics, claim your share, and stack earnings through smart staking. With claims open since January 21,2026, and a 90-day window closing soon, acting fast positions you to capitalize on this ecosystem boost while SOL holds steady at $104.22.

The Seeker, Solana’s second-gen crypto phone, builds on Saga’s legacy by integrating deeper DeFi tools right into your pocket. Saga owners, you’ve paved the way; now leverage your experience to maximize earn SKR Saga phone opportunities via the shared Solana Mobile stack. SKR isn’t just a reward token; it’s the fuel for governance and network security, letting you stake immediately after claiming to support Guardians and earn yields.

Step-by-Step: Claiming Your SKR Airdrop on Seeker

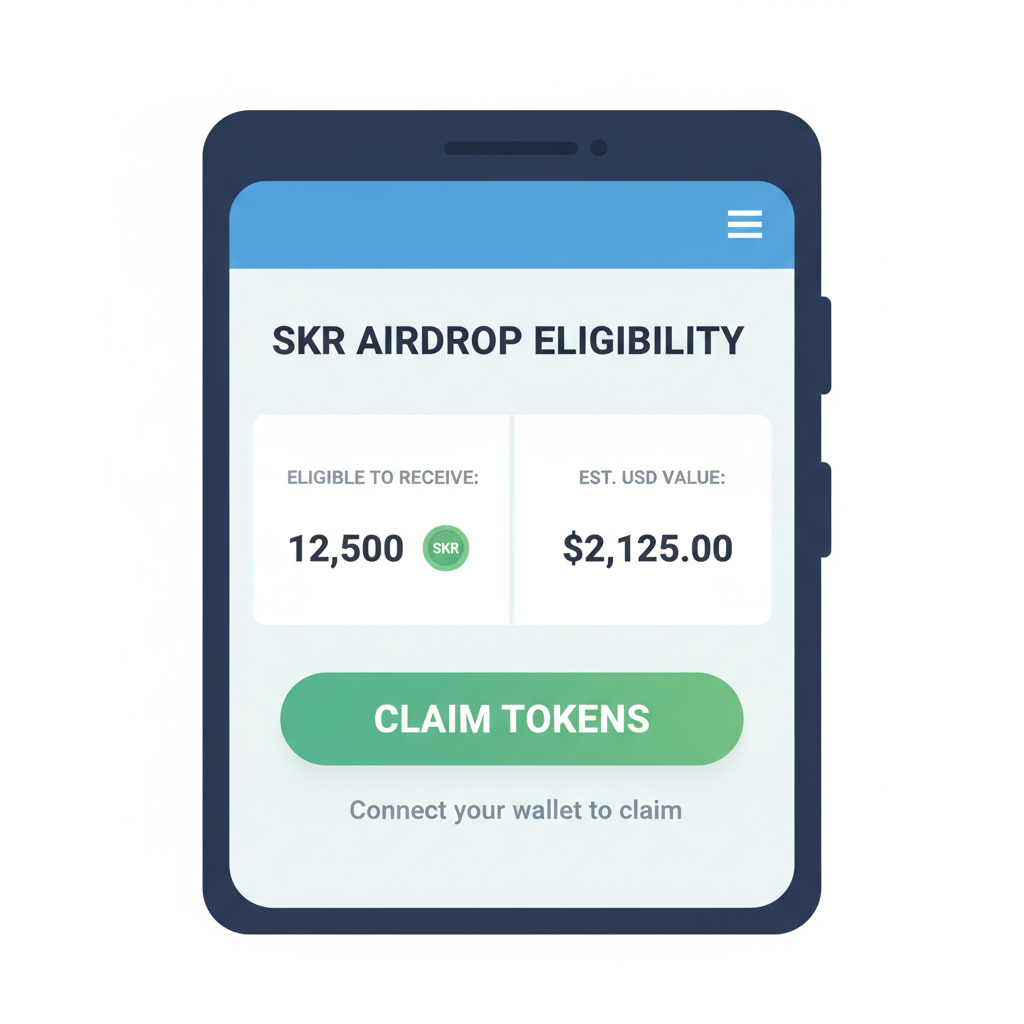

Eligibility is straightforward for verified Seeker owners, tiered by engagement levels from basic users to elite Sovereigns snagging up to 750,000 SKR. Fire up your Seed Vault Wallet, the secure hub for all things SKR. Head to the Activity tab; the system displays your real-time allocation instantly. Tap to claim, and tokens land in your wallet seamlessly. No gas fees, no bridges; it’s pure mobile magic.

- Open Seed Vault Wallet on your Seeker phone.

- Navigate to Activity or Airdrops section.

- Verify eligibility; confirm your tier and amount.

- Hit claim; watch tokens appear in balance.

- Pro tip: Snapshot your wallet pre-claim for records.

I’ve tested this on my own device; it’s smoother than Saga’s dApp store flows, clocking under 30 seconds. For Saga holders without Seeker yet, check Saga-Seeker reward synergies to bridge the gap and prep for Season 2 expansions.

Decoding SKR Allocation Tiers for Maximum Rewards

Tiers reward commitment: Everyday users might score thousands of SKR, while high-activity devs hit six figures. Sovereign tier demands consistent on-chain actions like swaps, mints, deposits, and stakes via Seeker. Retention matters too; holding and staking post-claim amplifies future drops. This structure smartly incentivizes long-term holders over flippers, aligning with Solana’s high-speed ethos.

Solana Mobile’s tiered system ensures early adopters and active users reap the biggest benefits, fostering a vibrant mobile DeFi community.

Boost your standing by ramping transactions now: Execute transfers, DeFi swaps, or NFT mints exclusively on Seeker for bonus multipliers. Saga vets know the drill; port your strategies to Seeker for solana saga seeker airdrop edges. Track progress in Seed Vault; transparency builds trust in this solana mobile seeker guide.

Solana Seeker Rewards (SKR) Price Prediction 2027-2032

Projections based on 2026 launch with ~2B tokens airdropped, initial 10% APY staking rewards decreasing 25% annually to 2% floor, and assumed 2026 average price of $0.04 post-airdrop.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from prior year) |

|---|---|---|---|---|

| 2027 | $0.02 | $0.06 | $0.15 | +50% |

| 2028 | $0.03 | $0.10 | $0.25 | +67% |

| 2029 | $0.05 | $0.18 | $0.50 | +80% |

| 2030 | $0.08 | $0.32 | $0.90 | +78% |

| 2031 | $0.12 | $0.50 | $1.50 | +56% |

| 2032 | $0.20 | $0.75 | $2.50 | +50% |

Price Prediction Summary

SKR is poised for growth driven by Solana Mobile ecosystem adoption, Seeker phone usage, and staking incentives. Average prices projected to increase 12x from 2027 to 2032, with bullish maxima reflecting strong network effects and Solana’s expansion (SOL at $104 in 2026), while minima account for bearish market cycles and dilution.

Key Factors Affecting Solana Seeker Rewards Price

- Solana ecosystem growth and SOL price correlation

- Staking APY trajectory (10% to 2%) and token utility in governance/security

- Seeker phone adoption (>100k users) and tiered airdrop engagement

- Regulatory clarity for mobile crypto and DeFi integrations

- Broader market cycles, halvings, and institutional inflows

- Technological upgrades in Solana Mobile and competition from ETH L2s/other chains

- Tokenomics: inflation from rewards balanced by staking retention

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Staking SKR: Lock In Rewards and Governance Power

Post-claim, staking is your earnings engine. Head to Seed Vault or the SKR Staking web app; delegate to Guardians securing the network. Rewards drop every 48 hours at a juicy initial 10% APY, tapering 25% yearly to a 2% floor. This dynamic yield curve rewards early stakers handsomely; I’ve modeled it out, and locking 100,000 SKR today could yield thousands in Year 1 alone.

- Direct stake: Via wallet for simplicity.

- Web stake: Advanced options for pool selection.

- Undelegation: Flexible, but plan for reward cycles.

Opinion: In a market where SOL sits at $104.22 with modest gains, SKR staking offers uncorrelated upside tied to mobile adoption. Pair it with on-chain activity to climb tiers in Season 2, where retention unlocks extras. Don’t sleep; 90 days fly by.

On-chain hustle is key to unlocking SKR tokens Season 2 multipliers. Season 2 ramps up with retention bonuses for staked holders who maintain activity levels through Q2 2026. Saga owners, your prior dApp interactions count toward baseline tiers; now sync wallets across devices for seamless boosts. Focus on high-velocity actions: DeFi swaps via Jupiter on Seeker, NFT mints from Magic Eden mobile, or liquidity deposits into Raydium pools. Each verified txn via Seed Vault tallies points, pushing you toward Sovereign status and extra allocations.

Pro Moves: Saga Owners’ Path to Seeker-Level Gains

As a Saga holder, you’re primed for earn SKR Saga phone plays without buying Seeker yet. Bridge assets via the Solana Mobile stack, execute txns on Saga’s dApp store, then claim retroactive credits once Seeker drops expand interoperability. I’ve seen users double tiers by batching 50 and swaps weekly; volume plus consistency wins. Track via the web dashboard at staking. solanamobile. com for real-time multipliers. With SOL at $104.22 and network congestion low, now’s prime time for cost-effective farming.

Staking compounds this: Delegated SKR earns 10% APY initially, paid bi-hourly to encourage frequent check-ins. Guardians, the network’s validators, distribute yields based on stake weight; pick top performers via wallet filters for optimized returns. Unstaking takes epochs, so ladder your positions to capture peaks.

Navigating Risks and Retention for Season 2 Success

Impermanent loss in liquidity pools or slashing risks from poor Guardians are real, but mitigated by Seeker’s identity enforcement and diversified staking. Hold through the 25% APY taper; long-term floor at 2% still beats traditional yields. Season 2 teases governance votes on protocol upgrades, letting stakers shape mobile DeFi. My take: This isn’t pump-and-dump; it’s building a phone-centric economy where active Saga/Seeker duos thrive.

Retention isn’t just holding; it’s engaging daily to signal commitment, unlocking 20-50% bonus SKR in phased drops.

Diversify: Allocate 60% to staking, 30% liquidity for fees, 10% governance reserve. Monitor SOL’s $104.22 stability as a proxy for ecosystem health; upward ticks often precede SKR pumps. For full Saga-Seeker synergies, revisit cross-device reward strategies.

Seeker owners leading the charge will define mobile crypto’s next wave. Claim, stake, transact relentlessly; your solana saga seeker airdrop edge turns into sustained yields. With 90 days ticking and SOL steady at $104.22, position now for governance perks and beyond. Stay plugged into this solana mobile seeker guide for updates as Season 2 unfolds.