Solana Saga owners, your Genesis Token has unlocked exclusive rewards since 2023, but with official support ending in 2026, the clock is ticking. The Seeker phone emerges as the natural upgrade, priced at $450-$500 versus Saga’s original $1,000 tag. Pre-orders have hit 140,000 units across 57 countries, signaling robust demand amid SOL’s current price of $97.22, reflecting a 24-hour change of -$6.28 (-0.0607%) with a high of $104.86 and low of $96.64. This Solana Saga vs Seeker comparison breaks down why transitioning preserves your edge in mobile DeFi.

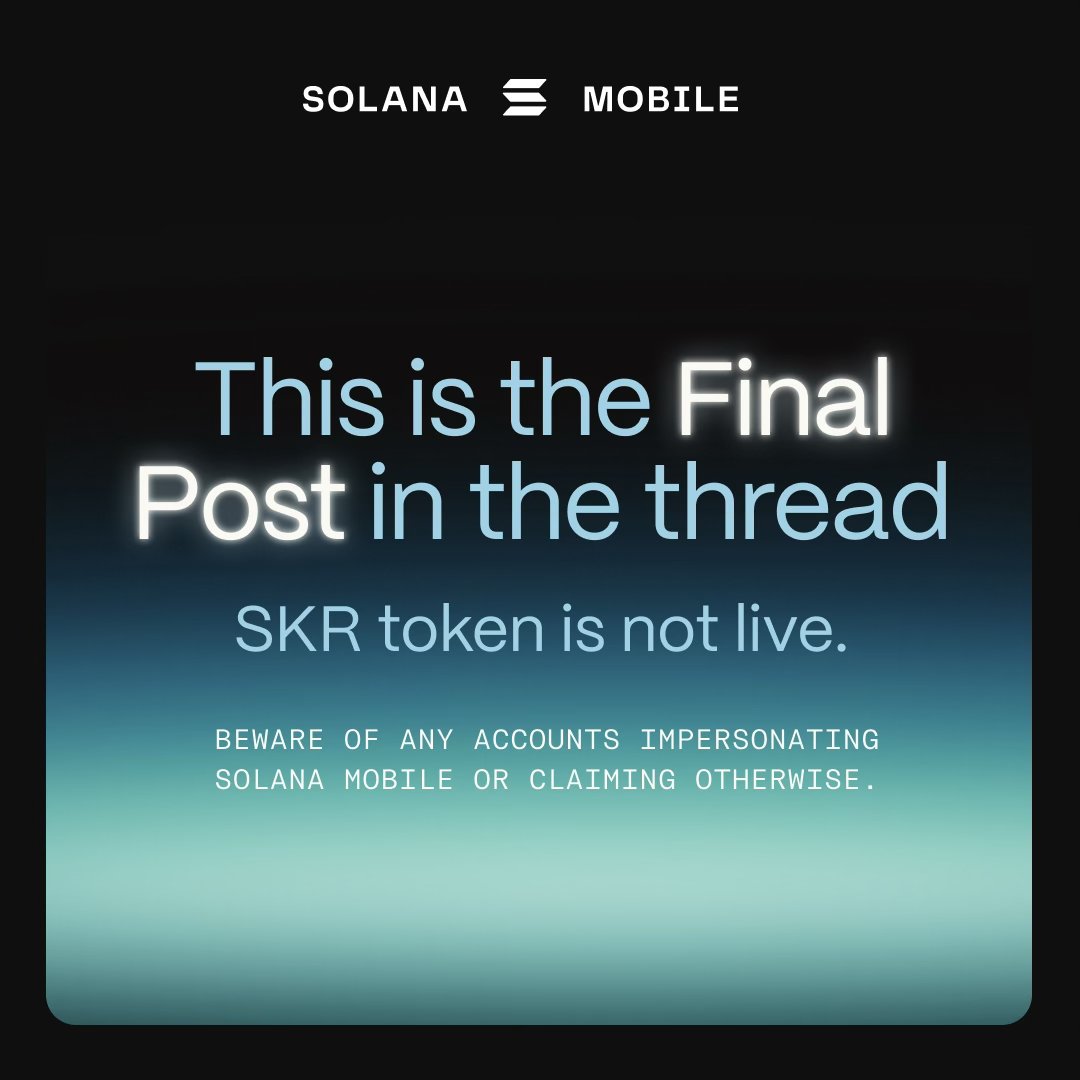

Genesis Token holders from Saga qualify for Seeker perks, including the SKR token airdrop. Solana Mobile’s 90-day campaign targets activated Seeker users and devs, distributing allocations tied to device identity. Nearly 2 billion SKR tokens now circulate, powering governance, staking, and a circular economy that rewards contributors. Check how to earn crypto rewards with Solana Saga and Seeker phones for deeper dives into airdrops and NFTs.

Saga’s Legacy Meets Seeker’s Hardware Edge

The Saga pioneered Web3 mobile with its Seed Vault for secure key custody and dApp Store integration. Yet, its bulkier design and premium pricing limited mass adoption. Seeker refines this: sleeker build, superior cameras, extended battery life, all while halving the cost barrier. Both leverage Backpack wallet and Solana’s high-speed blockchain, but Seeker’s dApp Store 2.0 adds developer tools and smoother UX.

Solana Saga vs Seeker Phone: Key Comparison for Genesis Token Holders

| Feature | Solana Saga | Seeker Phone |

|---|---|---|

| Price | $1,000 | $450-$500 |

| Design | Bulkier | Lighter, sleeker |

| Battery | Standard | Improved 🔋 |

| Camera | Basic | Enhanced 📸 |

| Genesis Token | Rewards ending | Continued + SKR airdrop 💰 |

| Pre-orders | N/A | 140k+ units (57 countries) |

For Solana crypto phone comparison 2026, Seeker’s affordability removes Saga’s friction. Data shows Saga users averaged higher transaction volumes early on, but Seeker’s lower entry point could democratize mobile DeFi trading. If you’re holding Saga, expect diminished app support post-2026; Seeker ensures future-proof access.

Genesis Token Transition: From Saga Airdrops to SKR Rewards

Saga’s Genesis Token gated elite perks like Bone Shards and Chapter 2 rewards, but Solana Mobile now funnels value to Seeker. Holders who activate a Seeker Genesis Token during Season 1 snag SKR allocations. Claims require ~0.02 SOL in fees, sending tokens to your linked wallet. Reddit threads buzz with users reporting claims, planning stakes for governance votes.

Solana Mobile dropped the SKR airdrop for Seeker users and devs – nearly 2B tokens circulating now.

This Saga Genesis Token airdrop Seeker pathway binds identity and custody to the device, diverging from Saga’s pitfalls. SKR underpins incentives: 30% for users, enabling staking yields and dApp governance. As a CFA charterholder, I see this as a calculated pivot – Saga built the foundation; Seeker scales it.

Cost-Benefit Breakdown for Upgrading Now

Weighing Saga loyalty against Seeker gains? Upfront: $450-500 investment. Returns: Ongoing SKR drops, enhanced hardware for daily DeFi, and preserved Genesis status. With SOL at $97.22, transaction costs stay negligible. Trade-in programs aren’t confirmed, but early adopters report 20-30% resale value on Saga units.

SKR Token (SKR) Price Prediction 2027-2032

Realistic forecasts based on Seeker phone adoption, Solana ecosystem growth, market cycles, and provided 2026 baseline (Bear: $0.02, Base: $0.05, Bull: $0.15)

| Year | Minimum Price | Average Price | Maximum Price | YoY Growth (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $0.025 | $0.07 | $0.22 | +40% |

| 2028 | $0.04 | $0.12 | $0.40 | +71% |

| 2029 | $0.06 | $0.25 | $0.80 | +108% |

| 2030 | $0.10 | $0.50 | $1.50 | +100% |

| 2031 | $0.15 | $0.90 | $2.50 | +80% |

| 2032 | $0.25 | $1.50 | $4.00 | +67% |

Price Prediction Summary

SKR token predictions reflect optimistic growth from the Seeker phone’s success (140k+ pre-orders), SKR airdrops, governance utility, and Solana’s ecosystem momentum amid a recovering SOL price (~$97 in early 2026). Average prices could 30x by 2032 in base case, with bull highs driven by adoption and bull cycles, while mins account for bear markets and competition.

Key Factors Affecting SKR Token Price

- Seeker phone adoption and Saga Genesis Token upgrades boosting demand

- SKR tokenomics: governance, staking, rewards, and 2B+ circulating supply

- Solana network growth (dApp Store 2.0, Seed Vault) and SOL price correlation

- Crypto market cycles, including post-2028 Bitcoin halving bull runs

- Regulatory developments favoring crypto mobile hardware and wallets

- Technological advancements in Web3 phones and competition risks

- Macro factors: economic conditions, investor sentiment, and ecosystem partnerships

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Solana Seeker upgrade guide starts here: Verify eligibility via Solana Mobile dashboard, prepare 0.02 SOL, claim post-activation. Risks? Dilution from 2B circulating supply, but staking locks mitigate this. My data-driven take: Upgrade secures Seeker SKR rewards Saga holders can’t ignore, positioning you for Solana’s mobile dominance.

Read more on Saga’s DeFi impact in how the Solana Saga phone is transforming mobile DeFi.

Transitioning demands precision. Saga holders must first confirm Genesis Token status via the Solana Mobile portal, then purchase and activate a Seeker to unlock SKR claims. With nearly 2 billion SKR in circulation, early movers capture peak allocations before dilution sets in. Governance power through staking adds long-term utility, especially as dApp Store 2.0 rolls out developer incentives.

This process binds your rewards to Seeker’s hardware-secured identity, a step up from Saga’s looser model. Activation during Season 1 maximizes drops; post-deadline, allocations taper. Data from Breakpoint announcements pegs user shares at 30% of supply, favoring active devices. For solana seeker upgrade guide seekers, timing aligns with SOL’s stability at $97.22, keeping fees under $2.

Post-upgrade, expect seamless Backpack integration for on-device swaps and lending, unhindered by Saga’s fading support. My analysis: Seeker’s 140,000 pre-orders signal network effects that amplify SKR value, outpacing Saga’s niche appeal.

SKR Tokenomics: Rewards Aligned with Device Loyalty

SKR’s design ties value to usage. Allocations reward Seeker activation, dev contributions, and staking locks. Circulating supply hit 2 billion post-airdrop, but vesting schedules curb dumps. Governance lets holders vote on dApp priorities, fostering a self-sustaining loop. Reddit users report varied claims – from thousands to tens of thousands SKR – based on Saga-era activity.

SKR Token Breakdown

| Metric | Details |

|---|---|

| Circulating Supply | 2B tokens |

| Allocations | 30% users, devs, and incentives |

| Claim Fee | 0.02 SOL ($1.94) |

| Utility | Governance, staking yields |

| Risks | Dilution, market volatility |

Compared to Saga’s Bone Shards, SKR offers tangible staking APYs, projected at 5-15% in bull scenarios. As SOL hovers at $97.22 (24h low $96.64), liquidity supports frictionless claims across chains.

Genesis holders upgrading preserve status quo plus gains. Saga’s end-of-support risks app silos; Seeker unifies it all under dApp Store 2.0. Trade-offs? Minimal, given resale offsets costs.

Addressing Transition Hurdles

Market dynamics favor action. Pre-orders across 57 countries underscore Seeker’s momentum, positioning it as Solana’s mobile flagship. For seeker skr rewards saga holders, this pivot isn’t optional – it’s the data-backed path to sustained DeFi edge. Activate, claim, stake; let your device dictate the rewards.

Explore Saga’s trading prowess further at Solana Saga phone seamless mobile DeFi trading guide.