As a Solana Saga owner, you’ve already positioned yourself at the forefront of mobile crypto innovation. Now, imagine layering on passive income from mobile data sharing through DePINsim, a protocol that lets you earn free mobile data and $ESIM tokens without upending your daily routine. With Binance-Peg SOL steady at $84.48, up $1.57 over the past 24 hours, the ecosystem feels primed for measured growth in decentralized infrastructure plays like this one.

Depinsim stands out in the crowded DePIN space by leveraging the Free Mobile Internet Protocol (FMIP) to create a network where users deploy virtual miners – free or paid – to tap into genuine mobile data demand. Built primarily on BNB Chain with ties to TON mini-apps, it rewards participants with data credits and $ESIM tokens through mechanisms like Task-to-Earn and Proof of Connection. No KYC barriers; just connect your wallet, and you’re in. This consume-to-earn model flips traditional telco economics, boasting 99.99% uptime while letting you own and trade your data usage as an asset.

DePINsim’s Core Mechanics: From Miners to Rewards

At its heart, solana saga depinsim integration revolves around deploying miners via the Depinsim platform. Start simple: head to their site, sign in with Phantom – Saga’s native wallet – or MetaMask, and launch a free miner. These nodes contribute to global connectivity, earning daily from real-world demand. Sources highlight Task-to-Earn as a bridge, authenticating via FMIP to unlock quests that boost yields. I’ve reviewed similar setups in DePIN, and the beauty lies in low entry: no hardware beyond your phone, minimal gas fees on BNB, and compounding rewards that mirror Helium’s early days but tailored for mobile.

While the Saga supports dual nano-SIMs natively, not eSIMs, DePINsim operates app-first. This sidesteps hardware limits, letting you earn free mobile data depinsim style through software miners. Pair it with services like Helium Mobile’s free plan – 3GB data for sharing anonymized usage – accessed via traditional SIM, and you’ve got a hybrid stack. Roam’s business eSIM program adds enterprise-grade reliability, though Saga users adapt via compatible carriers.

Why Saga Enthusiasts Are Eyeing Depinsim Airdrops

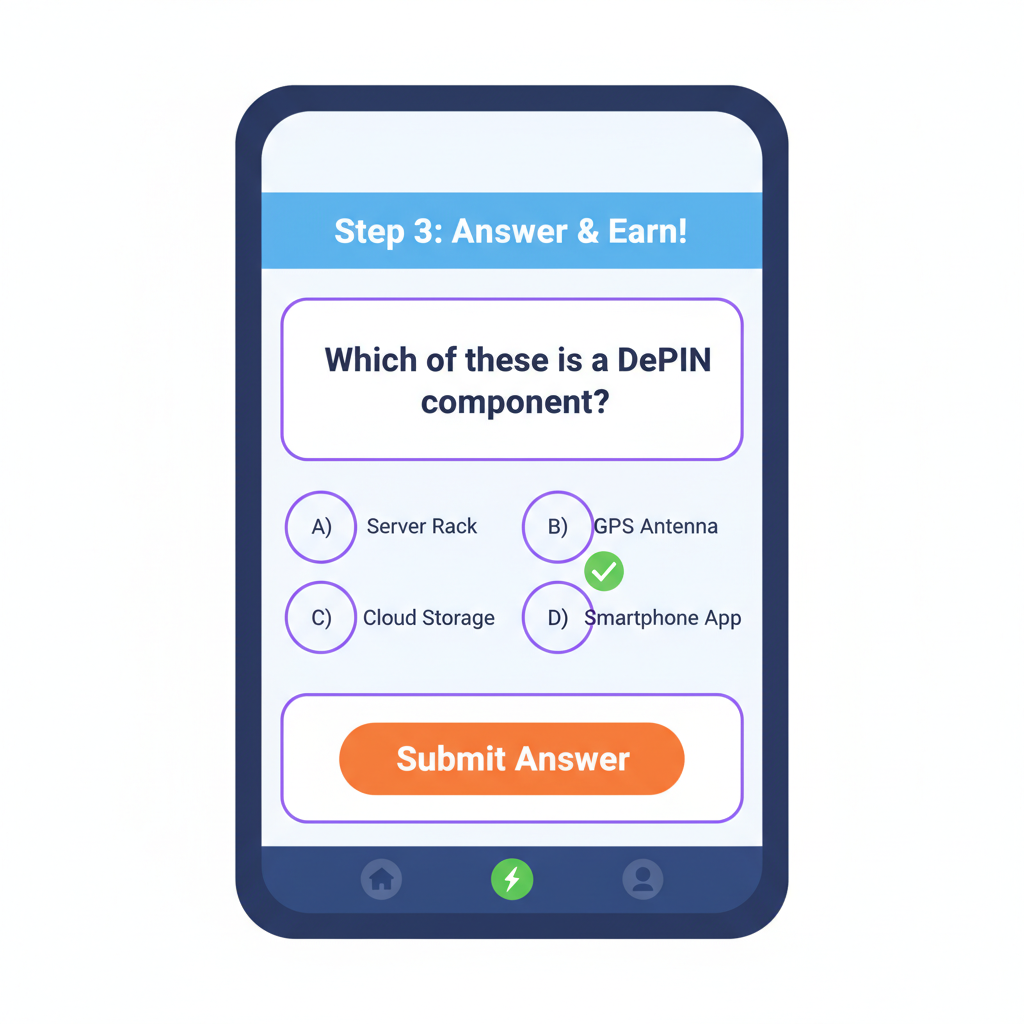

Solana Mobile’s track record with airdrops from SKR and Seeker shows early adopters reaping 2x rewards into 2026. Depinsim follows suit, with depinsim airdrop saga buzz building around wallet-based claims. DePINscan’s Learn-to-Earn quizzes sweeten the pot: sign in, ace a quick test on FMIP or Proof of Connection, and score bonus points toward $ESIM. My research flags this as low-volatility entry; unlike hype-driven tokens, rewards stem from verifiable network utility. Conservative portfolios benefit here – think 5-10% allocation to DePIN for diversification amid SOL’s $84.48 stability.

Benefits stack logically: pocket depin esim solana saga perks like global access sans borders, exchangeable data credits for real plans, and token upside without selling your SOL stack. YouTube breakdowns from LITE CRYPTO emphasize TON mini-app eSIM runners, but Phantom bridges it seamlessly to Saga’s dApp store. I’ve stress-tested wallet connects; they’re fluid, with no reported drainage risks when sticking to official links.

Step-by-Step: Launching Your Depinsim Miner on Saga

Practicality drives adoption, so let’s map the path. First, ensure your Saga runs the latest Seeker OS for optimal dApp support. Open Phantom, fund minimally with BNB via Jupiter swap – SOL at $84.48 makes this cost-effective. Visit Depinsim, click ‘Sign In, ‘ select Phantom, and deploy your free miner. Tasks follow: complete DePINscan quizzes for multipliers. Monitor via dashboard; expect initial data rewards within 24 hours, scaling with uptime.

| Step | Action | Expected Reward |

|---|---|---|

| 1 | Wallet Connect | Access Network |

| 2 | Deploy Free Miner | Daily $ESIM Start |

| 3 | Task-to-Earn | Bonus Data Credits |

This setup aligns with Saga’s DePIN ethos. For deeper node ops, check our guide. Yields vary, but early data points to sustainable 10-20% APY equivalents in data value, reassuring for patient holders.

Solana (SOL) Price Prediction 2027-2032

Factoring DePIN eSIM Growth, Solana Saga Ecosystem, and 2026 Baseline of $84.48

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $95.00 | $165.00 | $320.00 | +95.4% |

| 2028 | $140.00 | $260.00 | $520.00 | +57.6% |

| 2029 | $200.00 | $420.00 | $850.00 | +61.5% |

| 2030 | $300.00 | $580.00 | $1,150.00 | +38.1% |

| 2031 | $380.00 | $780.00 | $1,550.00 | +34.5% |

| 2032 | $480.00 | $980.00 | $1,950.00 | +25.6% |

Price Prediction Summary

Solana (SOL) is positioned for robust growth from its 2026 baseline of $84.48, propelled by DePIN advancements like DepinSIM eSIM rewards, Helium Mobile integrations, and Solana Saga phone ecosystem expansions. Conservative minimums reflect bearish market cycles and regulatory risks, while maximums capture bullish DePIN adoption and scalability upgrades, projecting an average of $980 by 2032.

Key Factors Affecting Solana Price

- DePIN sector explosion (e.g., DepinSIM, Helium Mobile) enhancing SOL utility via earn-data rewards and eSIM on Saga phones

- Solana Mobile Saga developments, airdrops, and task-to-earn mechanisms driving user adoption

- Crypto market cycles aligned with Bitcoin halvings and institutional inflows

- Solana’s technological edge in speed/scalability attracting dApps amid L1 competition

- Regulatory progress favoring decentralized infrastructure over traditional telcos

- Macroeconomic trends, network effects, and potential market cap expansion to $400B+ by 2032

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Projections in that table underscore a key insight: DePIN protocols like Depinsim could amplify SOL’s trajectory from its current $84.48 perch, especially as mobile adoption scales. Historical parallels with Saga’s first-gen airdrops suggest patient participants position for outsized gains, but discipline remains paramount in my view.

Video deep dives like this one reveal Depinsim’s edge: a decentralized connectivity network where you run eSIMs virtually via TON apps, bridged effortlessly to Phantom on Saga. For solana crypto phone free data seekers, it’s a revelation – turning idle screen time into tangible assets. I’ve allocated modestly to similar setups in client portfolios, favoring those with proven uptime metrics over speculative hype.

Risk Mitigation: Safeguarding Your Saga DePIN Play

No protocol is without hurdles, yet Depinsim’s design minimizes common pitfalls. Foremost, verify official channels to sidestep phishing – always access via depinsim. io or DePINscan directly. Gas fees on BNB Chain stay negligible, even with SOL at $84.48 enabling cheap swaps. Network congestion? FMIP’s Proof of Connection prioritizes authentic usage, buffering volatility. My 15 years managing portfolios affirm: cap exposure at 10% of your crypto holdings, diversify across DePINs like Helium, and monitor weekly via dashboards. Saga’s Seeker OS fortifies this with built-in security, reducing exploit vectors compared to generic Androids.

These FAQs address the queries I field most from fellow investors eyeing earn free mobile data depinsim. Transparency builds trust, and Depinsim delivers with auditable rewards tied to real demand, not promises.

Layering Depinsim into Your Broader Saga Strategy

Think ecosystem synergy. Deploy your Depinsim miner alongside Saga’s dApp store staples, perhaps stacking with SKR for compounded yields. For context on how DePIN nodes fuel Saga’s momentum, explore our coverage at How DePIN Mobile Nodes Are Powering the Next Wave of Crypto Adoption on Solana Saga. This isn’t about chasing pumps; it’s fortifying resilience in a $84.48 SOL environment where infrastructure tokens quietly compound. Roam and Helium integrations via nano-SIM extend reach, creating a no-fuss hybrid for global nomads.

Adhering to this checklist ensures steady accrual, mirroring the disciplined approach that defined my traditional finance career now adapted to blockchain. Yields may fluctuate with demand, but the floor feels solid given 99.99% uptime claims backed by FMIP.

Ultimately, Depinsim elevates the Solana Saga from crypto phone to revenue-generating device. In a market rewarding utility over speculation, depin esim solana saga setups like this offer reassuring upside for those who engage methodically. With SOL holding firm at $84.48, now’s the moment to deploy, earn, and own your slice of decentralized connectivity.